The K500 end-of-2017 report

You’re all eager to know how the cars in your garage have fared over the last 12 months, and whether your chances of acquiring others have improved or declined.

We’ve crunched four years’ auction results for you, to establish what’s really happening in today's market below the froth of big-ticket sales and occasional saleroom shocker. For the complete low-down and Simon’s opinion, read on…

At a glance:

(Based on combined results from RM, Gooding, Bonhams and Artcurial, at Scottsdale, Paris†, Amelia Island and Monterey from 2014 to 2017)

* Tastes are changing and the stats show a preference for younger cars: the average year has moved from 1957 to 1966

* Average price per car sold in 2017 $503k vs. $569k in 2014, a fair reflection of the overall shift

* Sold by number down since 2014, but slightly up on 2016; the 2015-2016 softening has been arrested

* Allowing for RM’s one-off, $67m Pinnacle Portfolio in 2015, the annual total sold has slipped just 5%

* Numbers offered increased slightly, with nearly 50% now listed Without Reserve

* Trend for cars sold below low estimate and not beating top continued, but has stabilised

†Euro/dollar conversion on the day

As K500 reported throughout 2017, the ‘best of the best’ continued to generate serious interest while the ‘rest’ needed a realistic estimate and an acceptable back-story. Witness the increase in No Reserve and 63% of lots sold under low estimate.

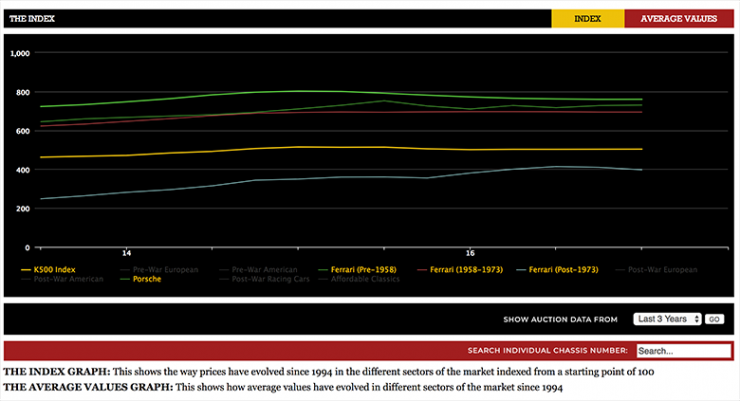

The corrections of 2015-2016 have flattened out.

The K500 Index of all auctions over this period – but only K500 cars – reflects this. From a high of 514 in early 2015, it currently stands at 503, buoyed by still-strong results on blue-chip and ‘new era’ models and shored up by the continuing popularity of 'affordable classics'.

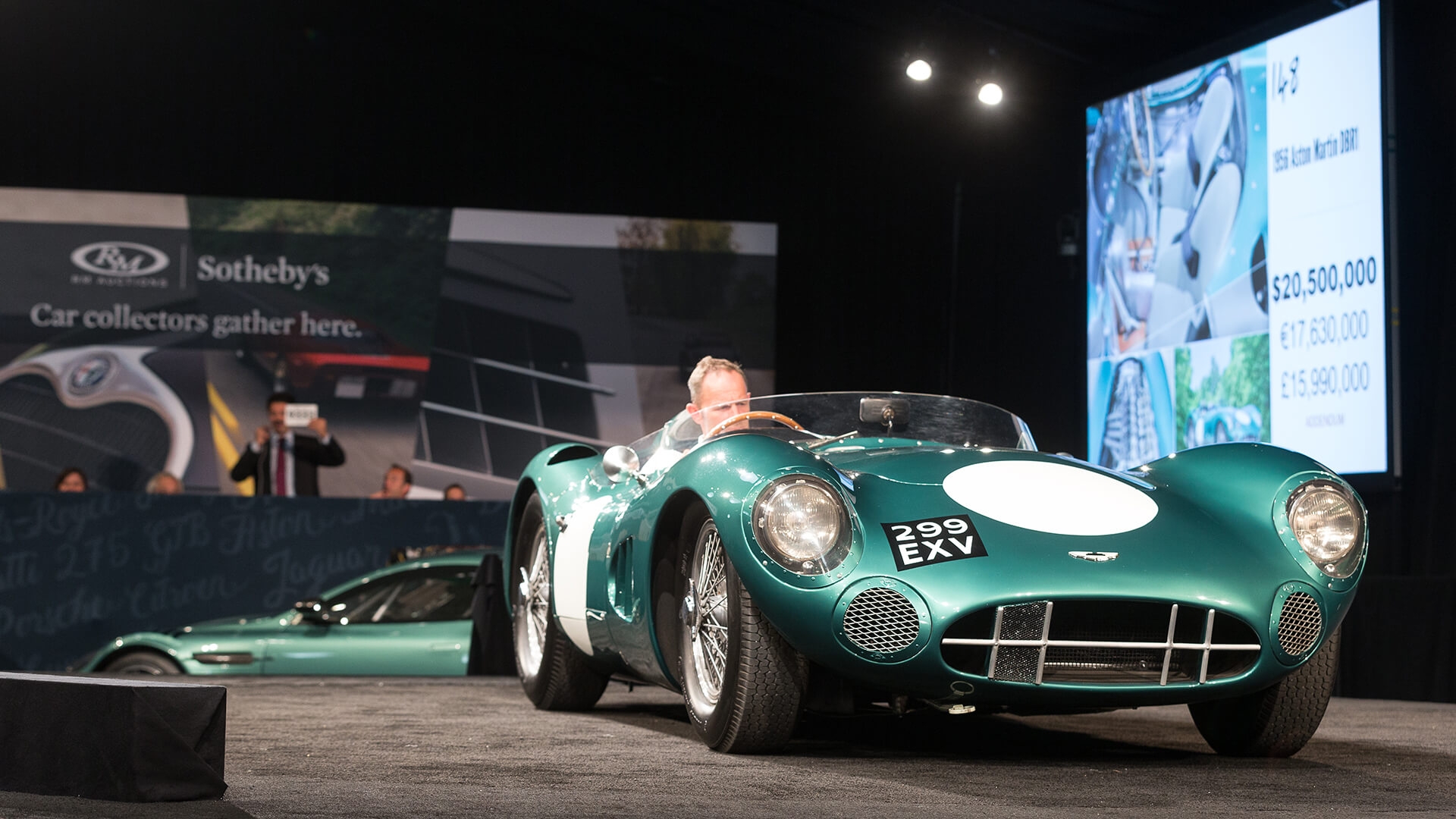

The last word goes to Simon: “It’s the same old story: the market keeps polarising with the ‘must-have’ models continuing their ascent and ‘also-rans’ relegated to the back. Older, stodgier models – think anything that requires a chauffeur or reminds you of elderly aunts – are going nowhere. 'One of fewer than zero' is music to new collectors’ ears and the words 'never offered before', 'under the radar' (usually wishful thinking) and 'one owner' (leaving aside 10 dealers since) still have magical, wallet-inducing cachet.

“In short, those who own great things know it, and so do the right collectors. Sooner or later they usually meet and magic happens. The other 99% is more of a bumpy ride.”

| 2017 | 2016 | 2015 | 2014 | |

| Total gross cars: | $593,049,623 | $629,673,941 | $679,562,976 | $621,499,321 |

| Number of cars not sold: | 257 | 268 | 176 | 178 |

| Total number of cars: | 1434 | 1374 | 1382 | 1269 |

| Number sold: | 1177 | 1106 | 1206 | 1091 |

| Percentage cars sold by number: | 82% | 80% | 87% | 86% |

| Percentage of cars met or sold below low estimate: | 63% | 63% | 51% | 45% |

| Percentage of cars sold below avge of estimates: | 81% | 80% | 67% | 67% |

| Percentage of cars sold met/exceeded top estimate: | 11% | 12% | 21% | 21% |

| Average price of cars sold: | $503,865 | $569,325 | $563,485 | $569,660 |

| Average age of cars offered: | 1966 | 1962 | 1961 | 1957 |

| Percentage of cars offered at No Reserve: | 48% | 41% | 42% | N/A |

Photo by Thomas